Stock lending explained

Stake’s new stock lending feature lets customers earn income passively. We explore how it works, the benefits for its customers, and how to get involved.

The breakdown

- Stake is the first NZ share trading platform to offer stock lending.

- If you have a Stake account, you are automatically opted-in to the stock lending program.

- Your stocks are protected by 102% collateral that must be provided by the borrower.

Author: Kevin McHugh, Head of Publishing at Banked.

Share traders usually rely on the value of their stocks increasing and then selling or dividend payments to generate income.

Stock lending is another way for investors to earn income. It’s not a new concept, but Stake is the first share trading platform to make it available to NZ customers.

What is stock lending?

Stock lending involves investors making their stocks available to their brokerage to be lent to another party, usually a hedge fund or bank.

These institutions borrow stocks for a variety of reasons, including short selling.

Lending stocks to large organizations, rather than individuals, provides greater certainty the stocks will be returned, reducing risk to the investor. Individuals are more likely to default on repayments for borrowed stocks.

How does it work?

Before we dive in, it’s helpful to point out that it’s technically not Stake that is lending your stocks out, but its US broker-dealer partner, DriveWealth. It’s this partnership with DriveWealth that makes it possible to access US stocks at all. Side note: both Sharesies and Hatch also partner with DriveWealth to provide their customers with access to US stock markets.

Stock lending involves three parties: the investor (you), a brokerage (Stake/DriveWealth), and a borrower. The brokerage lends out your stocks to the borrower for a fee. The brokerage then shares a percentage of the money earned on this fee with you, the investor. This is called a Stock Lending Payment and it’s 20% of what is charged to the borrower.

Only 20% of the total money being made may sound like a rough deal — especially when the stocks are yours in the first place. However, it is worth bearing in mind that many brokerages do the same thing but fail to pass on any of the profits to the person who actually holds the investment.

Any money you make from stock lending is paid directly to your Stake account on the 15th day of each month.

It’s also important to note that your investment will only be used for stock lending DriveWealth finds a party interested in borrowing them. Opting into the stock lending scheme does not automatically mean your stocks will be used.

How to start stock lending

Stock lending went live with Stake on 13 July, and if you have a Stake account, you have been opted-in automatically. If you sign up for Stake at some point in the future, you too will be automatically opted-in to Stake’s new stock lending program,

While Stake is the only share trading platform that directly offers stock lending to NZ customers, there are other options from international brokers.

For example, Interactive Brokers offers a version of stock lending through its stock yield enhancement program. However, Interactive Brokers’ offering is more complex and involves a much higher bar to entry – customers must be approved for a margin account and have a cash account with equity greater than $50,000 USD (approximately $80,000 New Zealand dollars).

The only change to Stake’s investing platform is the option to opt-in/out of stock lending. Any Stake users not wishing to have their stocks used in the program can opt out via the app’s settings.

Top 5 FAQs about stock lending

As a new investing feature, there are lots of questions about stock lending. We answer your top questions here.

1. How much can I earn with stock lending?

There are just too many factors to take into account when trying to assess how much you could earn by making your Stake investment available for stock lending. These include:

- how long your stocks are lent for while you make them available

- the amount of demand for your stocks(those with higher demand with a higher fee)

- market conditions.

Stake itself has a stock lending profit calculator on its website that uses a hypothetical annualised interest rate of 1.5%. But, as Stake admits, the example earnings its calculator outputs are illustrative only.

If you are opted-in and want to know how much you have earned from stock lending, go to Settings > Tax and Documents > Account Statements in your Stake account. You will also be able to find out which of your stocks were on loan.

2. Does stock lending put my investment at risk?

You are protected if the borrower defaults and cannot return your stocks. All borrowers must provide cash collateral worth 102% of the stocks they have loaned. This provision is enforced by the US Securities and Exchange Commission, which also ensures your investment is protected if Stake’s partner DriveWealth becomes insolvent.

If the value of your investment goes up (or down), the amount of collateral will shift to ensure there is at least equal to the 102% required. This happens at the end of each trading day.

3. Can I sell my stocks if they are loaned out?

Your stocks remain in your name and your control at all times. You are free to sell them at any time, even if they are currently loan out to a borrower.

4. Can I opt-out of stock lending?

Yes, you can choose to opt out of Stake’s stock lending scheme at any time.

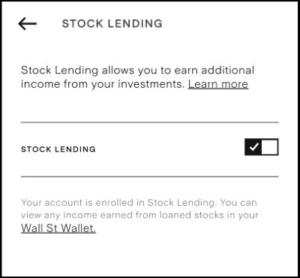

To opt-out, log into your Stake account and go to Settings > Trade Settings > Stock Lending Settings > and uncheck the ‘Stock Lending Income Program’ button. Below you can see a screenshot of what this page looks like on the Stake mobile app.

5. Will I still receive dividends on my stocks if they’re loaned out?

If you have Stake stocks that earn dividends, you will be please to know that you will continue to earn them while they are lent out.

Stake says that these loans are typically recalled before dividend payments and so the dividends are received as usual. However, if for some reason to loan is not recalled at that time, you will receive an equivalent cash payment.

The pros and cons of stock lending

Pros

- Stock lending allows you to passively earn interest on your Stake investment.

- It requires no effort or involvement from you as the investor.

- You can continue to earn dividends on stocks that are loaned out.

Cons

- Your stocks may be loaned for the purpose of short selling, which some consider problematic and unethical.

- That Stake automatically opts-in customers in without their express consent has aggravated some.

- It’s effectively impossible to know how much you could earn from stock lending.

You have no voting rights on your stocks while they are loaned out.