OFX money transfer review

Formerly known as NZForex in New Zealand, OFX is an international money transfer service with a network that stretches around the globe. We dive into OFX’s fees, the speed of their service, and much more in our review.

Updated: 16 July 2024

The breakdown

- The flat transaction fee of $12 for all transfers under $10,000 (with no fee for transfers more than that $10,000) means that OFX provides better value for larger transfers. The minimum transfer amount is $250.

- With OFX you can transfer money to more than 50 currencies.

- OFX offers 24/7 customer service, both for personal and business accounts.

Author: Kevin McHugh, Head of Publishing at Banked.

OFX exchange rate and fees

To provide a better exchange rate than the banks, OFX uses something it calls global-by-local (GBL) processing.

OFX holds currency reserves in 115 countries around the world and uses those reserves to complete your transfer. That means that if you transfer money, most of the time your funds will stay in New Zealand and OFX will pay the recipient from the reserves it holds in their country.

This means OFX can save money and time on money transfers and pass the benefits on to its customers. It also means it can sometimes offer same-day transfers, even when the banks are closed.

Fees

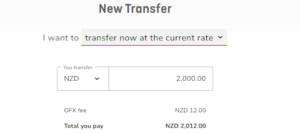

OFX’s fee system is very simple to understand. If you are transferring anything under $10,000 NZ dollars you will be charged a flat fee of $12; if you’re transferring $10,000 NZD or more, no fee will be charged.

Because of this flat fee system, the percentage you pay in fees with OFX can vary a lot and it certainly favours the transfer of larger amounts.

For example, if you transferred just $250, you would have to pay what amounts to a significant 4.8% transfer fee on top. However, if you transferred $9,000, you will effectively pay just 0.13% in fees. Anything more than $10,000 and you won’t pay any transfer fee at all.

Supported currencies

With OFX you can transfer money to over 190 countries around the world in more than 50 currencies. Here are the currencies currently supported by OFX:

|

|

|

|

Available payment methods and speed

OFX only offers bank transfer as the payment method for sending money. This is a convenient and common payment method for international transfer services but some may prefer the option of being able to pay by debit or credit or debit card, for example.

Once a transfer has been initiated and the bank transfer payment made, the time it takes your money to reach its destination can depend on a number of factors, including the country you are transferring money to and the day you are sending it. Transferring money to Australia or the US on a weekday, for example, could be completed the same day.

OFX states that transfers between major currencies will take between 1-2 days, while transfers to less commonly traded currencies may take between 3-5 days.

What’s special about OFX?

If being able to speak to a real person when you need customer support is essential to you, OFX is one of a few services that has you covered

24/7 support

Most international money transfer services are keen to move as much of their service online as possible to save money. OFX is an exception in that it has customer service support for both individual and business customers available 24 hours a day, 7 days a week.

Individuals can call 0800 161 868 free when they need assistance, and they can also email with any questions.

Like many services, OFX also has an online help centre that answers common questions that customers may have.

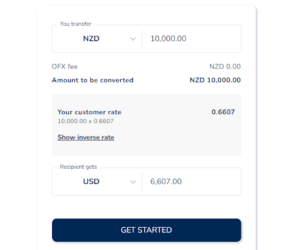

You can check the rate and fees before signing up

Many international money services request that you sign up, providing your personal contact details, before letting you know how much your transfer will cost.

OFX doesn’t do this. This means you can see the total cost of your exchange before registering.

This transparency makes it much easier to see how much you’ll pay in fees and what exchange rate you’ll get and can help you ensure you find the best deal.

Is OFX safe?

Yes, OFX is fully regulated within New Zealand.

OFX is the trading name of NZForex Limited trading in New Zealand and NZForex is registered as a financial service provider on the Financial Service Providers Register.

OFX is also regulated in other countries, including:

- Australia: OzForex Limited (trading as OFX) has an Australian Financial Services Licence issued by the Australian Securities and Investments Commission (ASIC).

- United Kingdom: OFX is also regulated in the United Kingdom by the Financial Conduct Authority.

- United States of America: OFX is registered as a Money Service Business at the federal level with the Financial Crimes Enforcement Network which is a bureau of the United States Department of Treasury.

OFX also maintains the security of its customer accounts with a number of measures including 2-factor authentication, automatic time-outs and SSL encryption when you log into the service.

How to transfer money with OFX

We take you through the steps involved from first registering with OFX to completing your transfer.

- Start your registration: Visit the OFX website and select ‘Register’ in the top right-hand corner of the homepage.

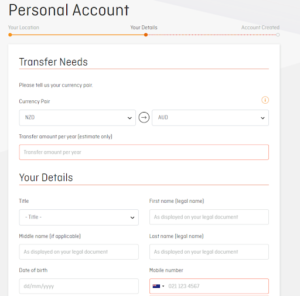

- Select your account type: You’ll first need to select if you want a personal or a business account. You will then need to enter the country you’re in and your email address. Your email address will also be your username.

- Enter your details: At this stage you will need to select which currency you will be transferring from and to along with how much you expect to transfer yearly. You will also need to enter some key personal details, such as your name, date of birth, and mobile number. An OFX customer service representative will call you to verify your account at a later time.

- Verify your identity: If you have a driver’s licence, verifying your account is simple. Just enter your licence number and OFX will be able to verify you digitally without providing any further documentation.

- Start your transfer: Select the ‘Transfer now’ button. You will then have the option to transfer at either the current rate or set a target rate. If you select the latter, you can choose an exchange rate and the transfer will be complete if and when the actual exchange rate meets that figure. Enter the amount you want to transfer, the currency you want to transfer to, and select ‘Continue’.

- Enter the recipient’s details: Now you will need to enter your recipient’s bank account details. The information you need can vary depending on which country you’re sending money to. For the bank details of some of the most common transfer countries (including Australia, India and the UK), check out our guide to international money transfers.

- Complete your transfer: Review the transfer you’ve just set up and make sure the details are correct. You will then need to pay your money via bank transfer to an OFX account in order to complete the transaction.

- Track your transfer: You can track the progress of your transfer through the ‘Deals and orders’ section of your OFX account. OFX will also email you at each stage of the transfer until it is complete.