Stake review

With access to OTC stocks and a stock lending feature, Stake offers a few things many of its competitors don’t. We look at what else Stake does, its fees and current promotions.

The breakdown

- Stake’s premium account, Stake Black, lets you buy over-the-counter (OTC) stocks, and gives you analyst ratings on potential investments.

- New customers can claim a free stock if they fund their account within 24 hours of opening it.

- Stake no longer offers 0% brokerage fees.

Key details

- Investment options: Shares, ETFs

- Transaction fee: US$3 for all trades up to US$30,000 and 0.01% for all trades above that.

- Subscription fee: $0 for standard, $15 per month for Stake Black

- Available markets: US

- Minimum investment: $10

- Mobile app: Yes

Current promotions

- Free stock on sign-up: Sign up to and fund your account within 24 hours and you’ll get a free stock of either Nike, GoPro, Dropbox, or a mystery stock.

- Refer a friend: Direct a friend to Stake and get a free stock. Again this free stock will be either Nike, Dropbox or GoPro.

Author: Kevin McHugh, Head of Publishing at Banked.

An introduction to Stake

Share trading app Stake was founded in Australia in 2017 and has since expanded across the ditch to New Zealand. Stake is one of several platforms that offer access to US shares and ETFs to Kiwis.

Like other micro-investing apps, it charges no subscription fee for its standard account. However, for more detail-oriented investors there’s Stake Black, an upgrade that offers in-depth company financial information, buy-sell ratings, and the ability to use funds from sales of shares that have not cleared yet.

Stake Black does involve a fee of $15 per month, or $156 for an annual subscription.

Investment options

Focusing solely on US share markets, Stake lets investors buy into more than 9,500 US stocks, ETFs, and government bonds. However, those with a Stake Black account can also invest in over-the-counter (OTC) shares that are not listed on any stock exchange. Read on for more.

Shares

The platform provides access to thousands of shares floated on US stock exchanges including the NASDAQ and the NYSE. This means that investors can buy into all of the major companies you would expect, such as Tesla, Apple, Amazon, Netflix and so on.

However, it also means there are many smaller companies that some investors will buy shares of in the hope that they’re the next big thing.

Over-the-counter (OTC) shares

Stake is almost unique among NZ share trading services in that it offers OTC shares. Unfortunately, OTC shares are only available to Stake Black subscribers.

OTC are unusual in that they are not traded on a stock exchange. Instead, they are traded through broker-dealer networks and trades are directly between buyers and sellers, with no exchange required.

Companies that trade as OTC stocks typically fall into 2 categories:

- American Depositary Receipt (ADRs): An ADR is issued by a bank or broker and it represents the shares of a stock traded on a foreign exchange. In more simple terms, it means you can invest in some companies not traded on US exchanges, such as Nintendo, Nissan and Bank of China.

- Smaller companies: Some small companies choose to float on exchanges because it’s expensive and complicated to do so.

There are almost 100 OTC stocks available, including:

- Grayscale Bitcoin Trust (GBTC)

- Zurich Insurance Group Ltd Sponsored ADRs (ZURVY)

- Adidas AG Sponsored ADRs (ADDY)

- Tencent Holdings Ltd. Unsponsored ADRs (TCEHY)

- Siemens AG Sponsored ADRs (SIEGY)

- Airbus SE Unsponsored ADRs (EADSY)

- Volkswagen AG Unsponsored ADRs (VWAGY)

- NINTENDO CO LTD Unsponsored ADRs (NTDOY)

- London Stock Exchange Group plc Sponsored ADRs (LNSTY)

- Bank of China Limited Unsponsored ADRs Class H (BACHY)

- Porsche Autombl Unsp/Adrs (POAHY)

- Ubisoft Entertainment SA Unsponsored ADRs (UBSFY)

Learn more about Stake’s OTC share offering on its website.

Exchange-traded funds (ETFs)

ETFs are basically a bundle of shares all bundled up in one investment, and Stake has over 1,200 of them available for investment. Learn more about ETFs in the Banked guide.

ETFs offer a way to diversify what you invest in through a single investment. For example, the popular Vanguard S&P 500 ETF (VOO) groups together all of the 500 largest US companies. If one or several of those companies perform badly, the value of your investment will still increase if the total value of all companies goes up overall.

Stake provides access to many ETFs that cover indexes (such as the S&P 500) as well as ‘thematic’ ETFs that group investments around a particular area or industry. Examples of thematic ETFs available through Stake include:

- ProShares Bitcoin Strategy ETF (BITO): BITO is an actively-managed ETF that lets investors buy into the performance of the Bitcoin cryptocurrency by exposure to Bitcoin futures.

- iShares Global Clean Energy ETF (ICLN): The ICLN ETF is invested in companies that produce energy from renewable energy sources, such as solar and wind.

- Global X Autonomous & Electric Vehicles ETF (DRIV): This ETF invests in companies that are involved in the development of autonomous and EV cars vehicles such as Tesla, Ford and Intel.

- ARK Innovation ETF (ARKK): ARKK is a popular thematic ETF that invests in innovative and disruptive technology companies. Those companies include Zoom, Coinbase and Spotify.

- First Trust Cloud Computing ETF (SKYY): The SKYY ETF provides exposure to companies involved in delivering cloud computing services.

Pricing and fees

Stake used to offer zero brokerage fees but now offers a flat fee for trades up to US$30,000.

At 1%, its currency exchange, or FX fee (the fee charged to change your NZ dollars into US dollars), is higher than competitors such as Sharesies and Hatch.

Here’s a look at all fees involved:

- Transaction/brokerage fee: US$3 for all trades up to US$30,000 and 0.01% for trades higher than that

- Subscription fee: There’s no fee for subscriptions to its standard service. However, if you subscribe to Stake Black it will cost you $15 per month. A discounted rate of $156 for 12 months is available. Learn more about Stake Black next in our ‘Top features of Stake’ section.

- Currency exchange fee: Also known as an FX fee, there’s a charge of 1% of the total amount you deposit in NZ dollars to convert it to US dollars.

- Instant funding fee: When depositing funds into your account you will have the choice of a standard or express funding. Instant ensures the funds will be cleared during the next US trading day, but comes at a charge of 0.5% of the amount deposited.

- US tax form fee: In order to invest in US shares and ETFs you have to complete and lodge a US tax form (a W8-Ben, W8-Ben-E or W9 form). Stake will do this for you automatically for a one-off fee of $5.

ETF investments typically also come with their own management fee, but this is charged by the manager of the fund (iShares, ARK and Vanguard are well-known fund managers) and not the share trading platform.

This fee is usually around 0.5-2% and is incorporated within the price of the ETF so you won’t see it as a separate fee in your account.

See how Stake compares on fees against Sharesies, Hatch, and other platforms in our guide.

Top features of Stake

There are several features of Stake that are unique or at least uncommon among its competitors. We take a look at them here.

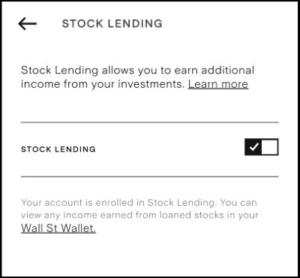

Stock lending

Stake is the first share trading platform in New Zealand to offer stock lending – a way of passively earning income on your investments.

Stake’s US broker-dealer, DriveWealth, lends Stake’s customer’s stocks out to borrower, typically for the purpose of short selling. The borrower is charged a fee to use these stocks and 20% of the money earned from that fee goes to the investor whose stocks were borrowed.

Stock lending was launched on 13 July and as of that date, all customers are automatically opted-in to the stock lending program. Customers are free to opt out of the program whenever they like.

Learn more about stock lending in our guide.

Mobile app

Stake has a slick mobile app for those who want to trade on the go or keep track of their portfolio without having to log in to the company’s website.

The mobile app is easy to use and provides the same features and functionality as its website account, with the added benefit being able to log in using biometric authentication such as a fingerprint sensor (if you have a phone that has that capability).

Through the app you can buy and sell shares and ETFs, add potential investments to your watch list, and even keep track of the latest share trading news and stock prices.

Stake Black

Stake Black is the platform’s premium option that includes a variety of different benefits that standard subscribers don’t get. These include:

- Instant buying power: When you sell shares it can take a day or two for the funds to clear and you can use them again to make other purchases. With Stake Black, those funds are available to you immediately.

- Financial data, analyst ratings and price targets: Subscribers get comprehensive data on stocks with which to make more informed decisions.

- OTC stocks: The option to purchase over-the-counter (OTC) stocks is only available to Stake Black subscribers. See the ‘Investment options’ section above for more information on buying OTC stocks through Stake.

To get access to these additional features you’ll be charged the subscription fee of $15 per month.

Free stock on sign-up

Stake is the only share trading platform that rewards you with a free stock for signing up. This free stock will be either Nike, Dropbox, GoPro or a mystery stock, but exactly which one you get will depend on chance.

In order to get your free stock you’ll need to open an account and be sure to deposit funds into it within 24 hours of it being open. You will then have the opportunity to ‘spin’ its free stock wheel and you claim whichever stock the wheel arrow lands on.

Is Stake safe?

In a nutshell, yes, Stake is regulated and has a number of protections in place that means it can be considered safe.

Stake is registered as a financial service provider and it holds a licence from the Financial Markets Authority (FMA) to provide a financial advice service.

What happens if Stake goes bust?

When you invest through Stake, you own the stock or ETF, but they are not technically held in your name. This is a ‘custodial’ system and it makes the features Stake and similar share trading platforms offer possible.

When you invest in shares through Stake, your shares are held by a US broker-dealer Stake partners with called DriveWealth. DriveWealth also partners with Sharesies and Hatch to provide the same service.

Your investments are held in the name of Citigroup (the custodian in this instance). You remain in control of the investment, and if you’re due dividend payments from your shares, they will go to you.

Therefore, as Stake does not hold your shares in the first place, if it were to go insolvent it would not affect your shareholdings. If DriveWealth (the company that does hold the shares) were to go under you would be protected by the Securities Investor Protection Corporation (SIPC) of which DriveWealth is a member.

SIPC insures your investments and cash as it’s held by DriveWealth up to a value of $500,000 USD.

What you need to sign up for a Stake account

Signing up for a Stake account is fairly simple. There are just a few requirements you must meet.

- Age: You must be 18 years of age or older.

- Identity: You must have a government-issued ID such as a driver’s licence or passport. If for some reason Stake can’t verify your identity using this information, you may need to provide extra info including a selfie of you holding your ID and a copy of a bank or utility statement.

- Bank information: In order to withdraw money from your account you must have an NZ bank account.

Remember to claim your free stock once you’ve registered — you only have 24 hours from your account opening to do it!

Pros and cons of Stake

Pros

- Only share trading platform to offer OTC shares and stock lending.

- Free stock when you sign up.

- Stake Black features instant buying detailed financial data on potential investments, and more (at a cost – see ‘Cons’)

- Has a simple mobile app so you can track your investments wherever you are.

Cons

- Recent fee increase means the overall cost of trading is often higher than other platforms.

- At $15 a month, Stake Black with have value for a limited number of users.

- You can only access US stock markets.

Conclusion

Stake offers access to US shares and funds through an easy-to-use mobile app and website. It also has some unique features such as stock lending and over-the-counter (OTC) shares.

But with the recent price hike, Stake is no longer as competitive as it once was. Its currency conversion (FX) fees were always higher than the competition, but it countered this by being the only platform in town to offer zero brokerage fees. The cost of the Stake Black subscription has also gone up significantly.

It’s true that other share trading platforms such as Sharesies have also upped their fees in recent months. But with a more limited product offering and less innovation than its Kiwi counterpart, Stake’s fee increase feels less warranted and there is less value overall.