Christmas Spending Report 2022

We asked more than 1,000 Kiwis about their planned spending for this year’s Christmas. This is what they told us.

Update: We have published our Christmas Spending Survey 2023.

Key findings

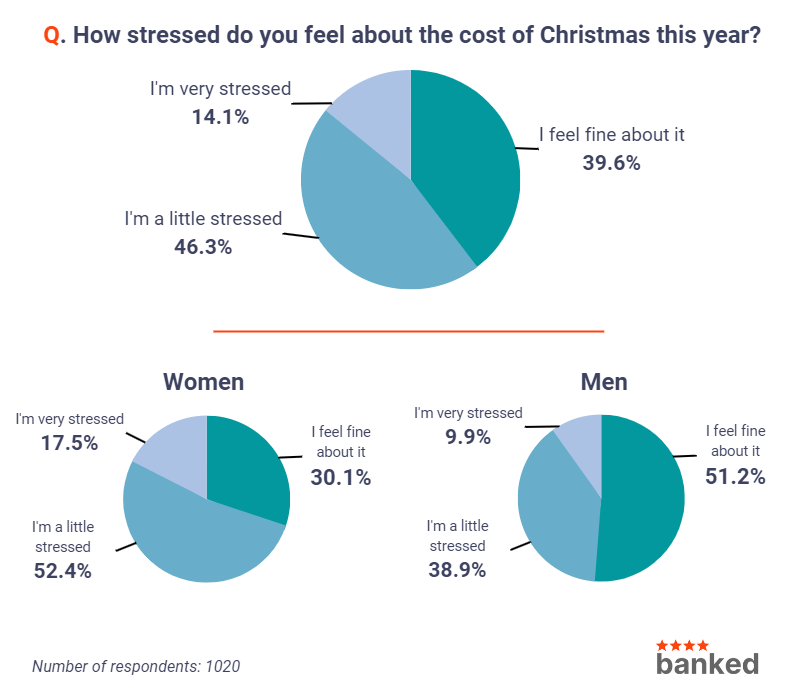

- 60.4% of Kiwis feel stressed about the cost of Christmas.

- 69.9% of women feel stressed, compared to 48.8% of men.

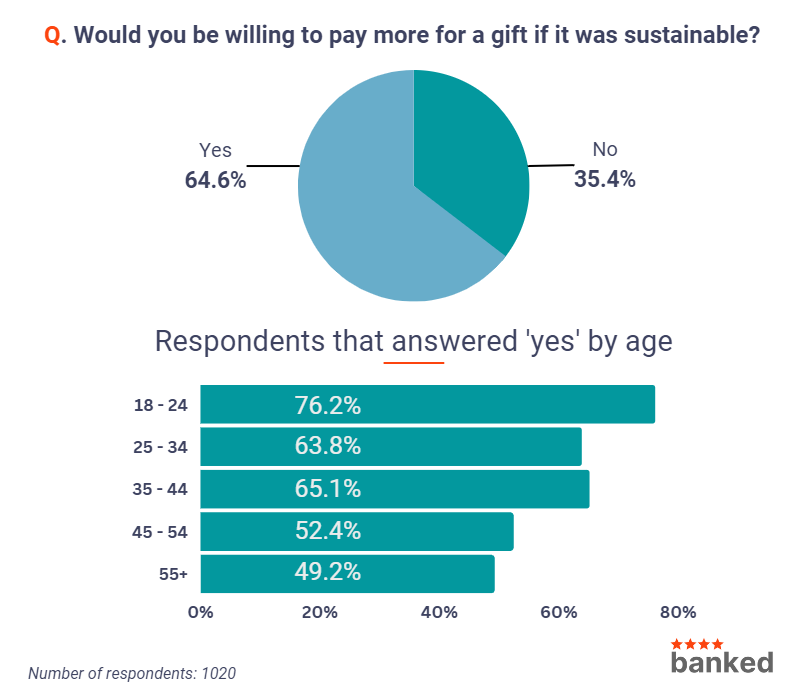

- Almost two-thirds of people would pay more for a gift if it was sustainable.

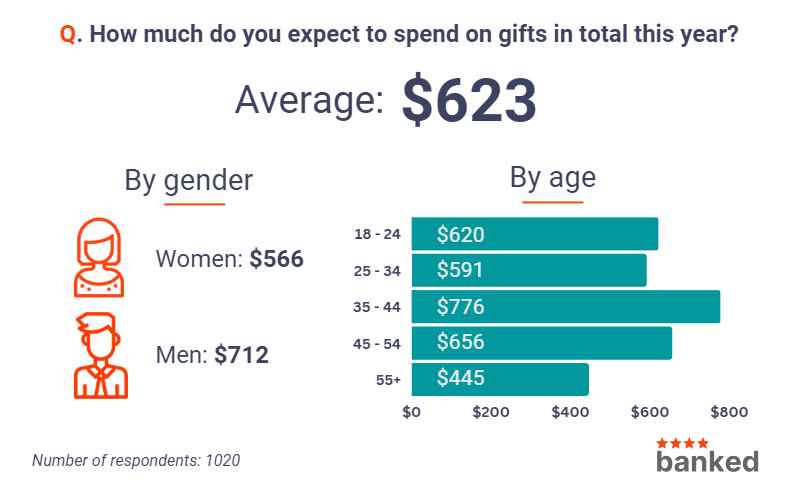

- Kiwis to spend an average of $623 on gifts this year.

Cost of Christmas putting women under pressure

When asked about how stressed they feel about the cost of this year’s Christmas, 60.4% of Kiwis said they were either a little stressed (46.3%) or very stressed (14.1%).

However, women reported significantly higher levels of stress than men. More than two-thirds (69.9%) of women reported they were either a little stressed (52.4%) or very stressed (17.5%).

Under half (48.8%) of men reported that they felt some level of stress about the upcoming expense of Christmas, while 51.2% said they felt fine about it.

Gen Z most interested in sustainable gift-giving

At 64.6%, almost two-thirds of Kiwis said they would be willing to pay more for a gift if it was sustainable (for example, one that involved zero waste or was made from recyclable materials).

But our survey shows that younger Kiwis are more interested in sustainable gift-giving than older generations.

Of those aged 18-24 (falling into to Gen Z age group), 76.2% said they would be willing to pay more for a sustainable gift. That willingness trends down overall as age increases and those aged 55 years and older are the only age group for which the majority would not pay extra for a sustainable gift.

Kiwis to spend an average of $623 on gifts

We asked respondents how much they expected to spend on gifts in total this year. The average amount was $623, although once again there proved to be a big difference between women and men.

Women said that they expected to spend $566 on gifts, 21% less than the total amount men expected to spend ($712).

New Zealanders between 35 and 44 years old expect to spend more on gifts this year than other age groups at $776. People aged 55 and over expect to spend least at $445.

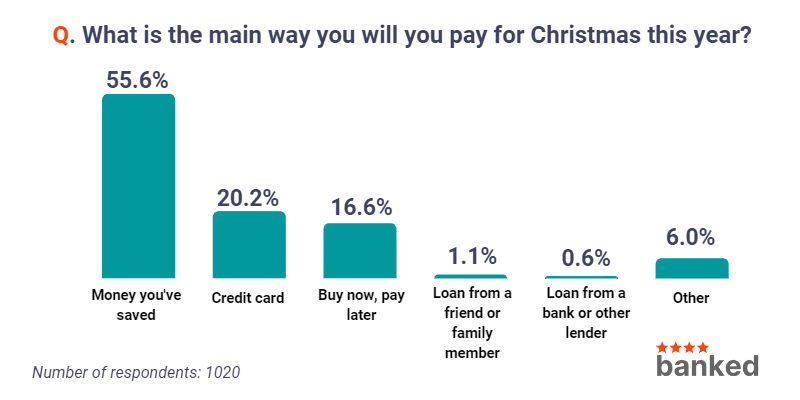

People drawing on savings for Christmas outgoings

Over half (55.6%) of New Zealanders will use money they’ve saved as the primary way to pay for Christmas this year. Just over 20% will call on a credit card as their main source of funding, and 16.6% of people will use a buy now, pay later (BNPL) service such as Afterpay or Klarna.

Men are much more likely to use a credit card than women for this purpose (28.7% vs 13.5%), while women are more prepared to use BNPL to fund their Christmas spending than men (22.4% vs 9.2%).

5 top ways to cut costs this Christmas

1. Don’t feel obligated to spend beyond your means

Christmas is an intensely commercial holiday, and many can feel pressure to spend money that they don’t have. This can lead to a lot of unnecessary stress — both on Kiwi’s wallets and their wellbeing.

Don’t feel an obligation to buy gifts you’ll struggle to afford or take part in every costly social event. Your friends and family know that spending more doesn’t mean you care more. Plus, as the cost of living continues to climb, you can expect everyone else to be tightening their belts too.

2. Secret Santa or group gifting

Arranging a Secret Santa instead is a great way to cut back on how much you spend on presents. Instead of shopping around for multiple gifts, everyone just buys one for another person in a group.

Not only does Secret Santa help you save money, it’s also more fun and it means you can spend more time and attention on choosing the right gift for a single person.

Group gifting (where several people chip in to buy a gift for a person, couple, or family) is another great way to save money. It also makes it possible to purchase an otherwise unaffordable gift.

3. Set a budget (and stick to it)

With so much going on, it can be easy to overspend at Christmas. But with a little planning early on and setting a budget, you can make managing your finances over December and the New Year much easier.

Depending on your plans, it can be helpful to have different budgets for gifts, social events, travel, and so on. It’s also vital to keep track of your spending to make sure you don’t go over your budget in one particular area or ensure you can make up for it by adjusting your spend in other areas.

4. Be smart about credit

Credit cards and buy now, pay later platforms may seem like a lifesaver by providing the funds you need through the Christmas period. But if you’re not careful, spending on credit can be a hole that you’re still struggling to dig yourself out of come autumn or winter.

Avoid paying for things on credit that you don’t have to and don’t expect to pay off in the near future. Interest charges and/or late payment fees can easily pile up and leave you ultimately spending more on your Christmas than you expected to.

If you plan to use a credit card, make sure you compare credit cards to find the best one for you.

5. Stock up for next Christmas

Wrapping paper, cards, decorations, even gifts — all of these can plummet in price once December 25 has passed. By planning ahead, you can save a lot on Christmas 2023 by stocking up on common festive products.

You can go into next year’s Christmas prepared and with extra money in your pocket.

This survey was conducted in November 2022 and comprised 1,020 New Zealand adults. All figures presented here have been rounded to one decimal point to improve reading comprehension.

To learn more or to request the full data set, please email us at [email protected].