Credit Card Survey Report 2024

We asked 800 New Zealand credit card holders to tell us about how they use their cards and what they value most.

Key findings

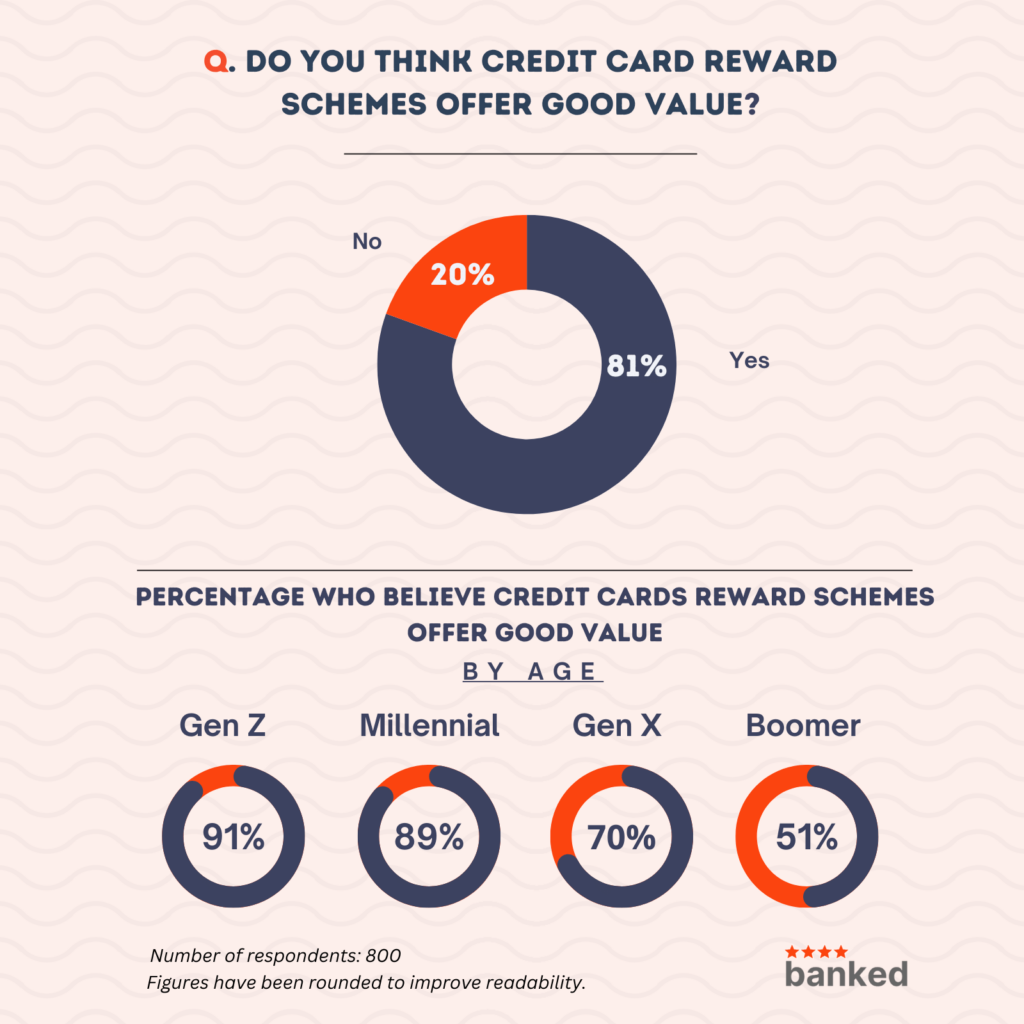

- Rewards schemes still valued: 81% still feel credit card reward schemes offer good value, despite a devaluation by banks.

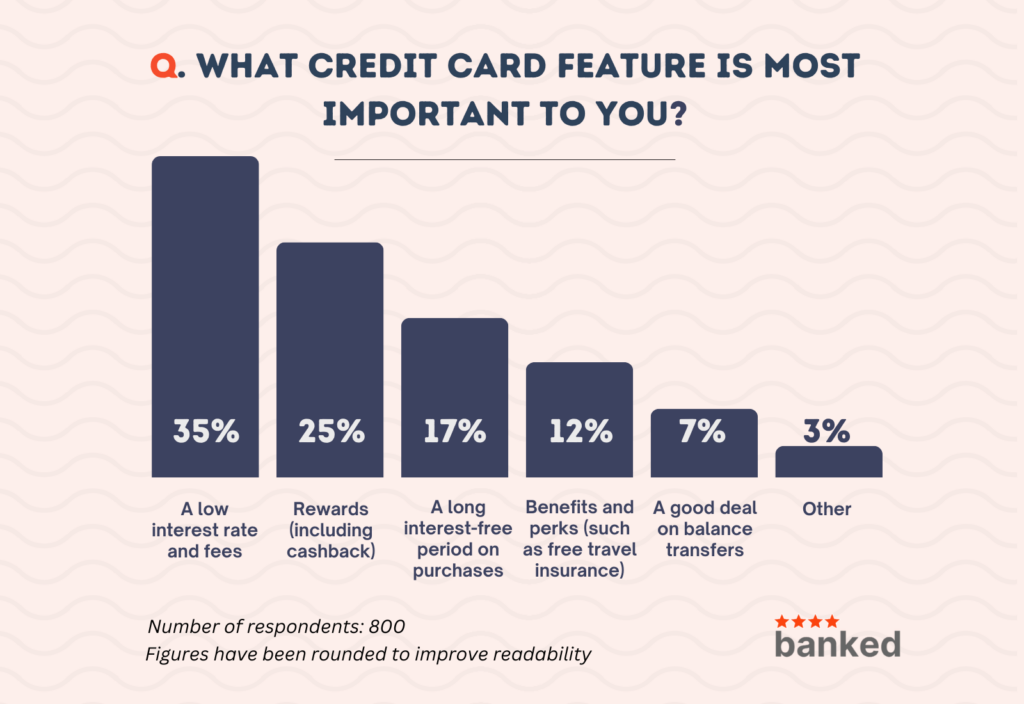

- Low rates are best: A low interest rate and fees are more important than benefits and perks or a good balance transfer offer, according to Kiwis.

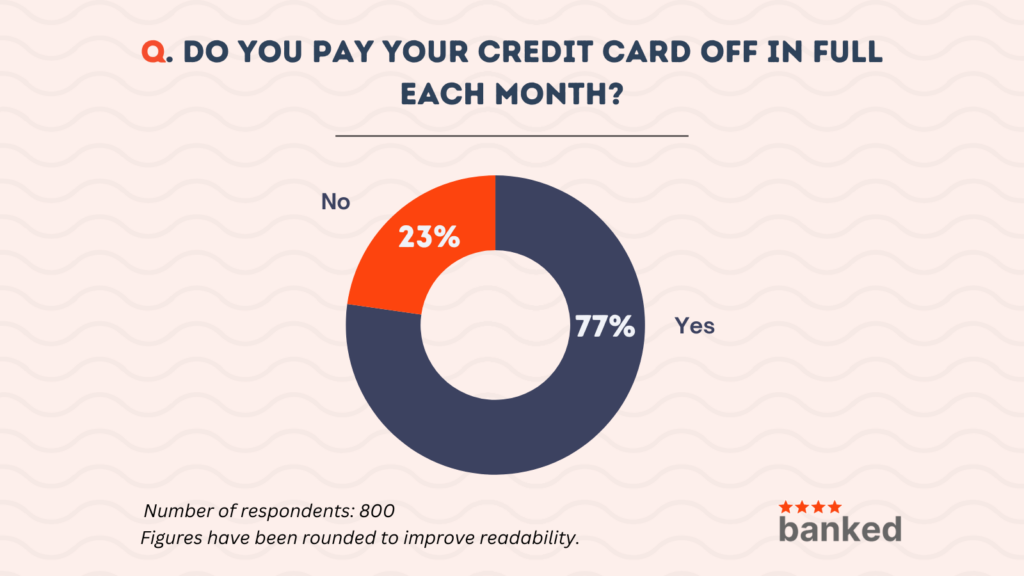

- Most avoid monthly interest: 77% pay their credit card balance off in full each month, avoiding interest charges.

Credit cards are an important financial tool for lots of New Zealanders and many have come to rely on them as inflation climbs and a cost of living crisis continues. A Banked survey found that 34% of Kiwis planned to use a credit card as their primary source of funding for Christmas 2023 spending — an increase of 14% over the previous year.

So, as the importance of credit cards grows for many, we asked 800 New Zealanders who either have or have had a credit card to tell use about how they use it and what’s most important to them in a card.

Kiwis still keen on reward schemes, despite value drop

The large majority of New Zealanders still believe credit card reward schemes offer good value, even after banks significantly reduced the earning potential of their cards.

In November 2022, the Government introduced a cap on credit card transaction fees. The resulting loss in revenue for banks prompted almost all of them to water down their credit card reward schemes, resulting in customers earning fewer reward points when spending on their card.

While many customers were frustrated with the move at the time, most still feel positively about credit card rewards. Overall, 81% still believe credit card rewards schemes offer good value. Younger people are keener on credit card rewards, with 91% of Gen Z and 89% of Millennials agreeing that they offer good value.

Gen X (70%) and Baby Boomers (51%) still see their value but are less impressed than their younger counterparts.

See our guide to to the best rewards credit cards for more.

A low interest rate and fees most important

Although credit card rewards are prized by New Zealanders, a low interest rate and fees are what many look for first in a credit card.

More than a third of people (35%) say that a low rate and fees matter most to them when choosing a credit card. The second most popular feature is rewards (including cashback), with 25% saying they are most important to them, while 17% said that a long interest-free period on purchases is the most important credit card feature.

Benefits and perks (such as free travel insurance) and a good deal on balance transfers were less important overall, with 12% and 7% of Kiwis naming it as the most important feature, respectively.

This order varies little across the different age demographics.

Most pay full balance to avoid interest

The majority of credit card holders (77%) pay their credit card balance off in full each month, ensuring they are not charged any interest on their spending.

Credit card companies offer an interest-free period on their cards (either 44 or 55 days). If users pay off spending made during that period within that same window, they are not charged any interest. This is the most cost-effective way to use a credit card and it’s also the only way to truly take advantage of a credit card rewards scheme.

For credit card holders who don’t expect to be able to pay off their balance in full each month, a card with a low interest rate is the most sensible choice.

The data and infographics provided here are free to share and republish with a reference to Banked.

This survey was conducted using the Pollfish survey platform in November 2023 and comprised 1,020 New Zealand adults (aged 18+). This report was based on the data from 800 of those respondents who stated that they either have or have had a credit card.

All figures presented here have been rounded to whole numbers to improve reading comprehension. Age ranges of each generation are defined as follows:

- Gen Z: 18 to 26

- Millennial: 27 to 42

- Gen X: 43 to 58

- Baby Boomer: 59 to 77

To learn more or to request the full data set, please email [email protected].