Nectar review

Nectar claims to provide personalised quotes for loans within 7 minutes. But other than being quick, what else does the lender offer?

Updated: 15 February 2025

The breakdown

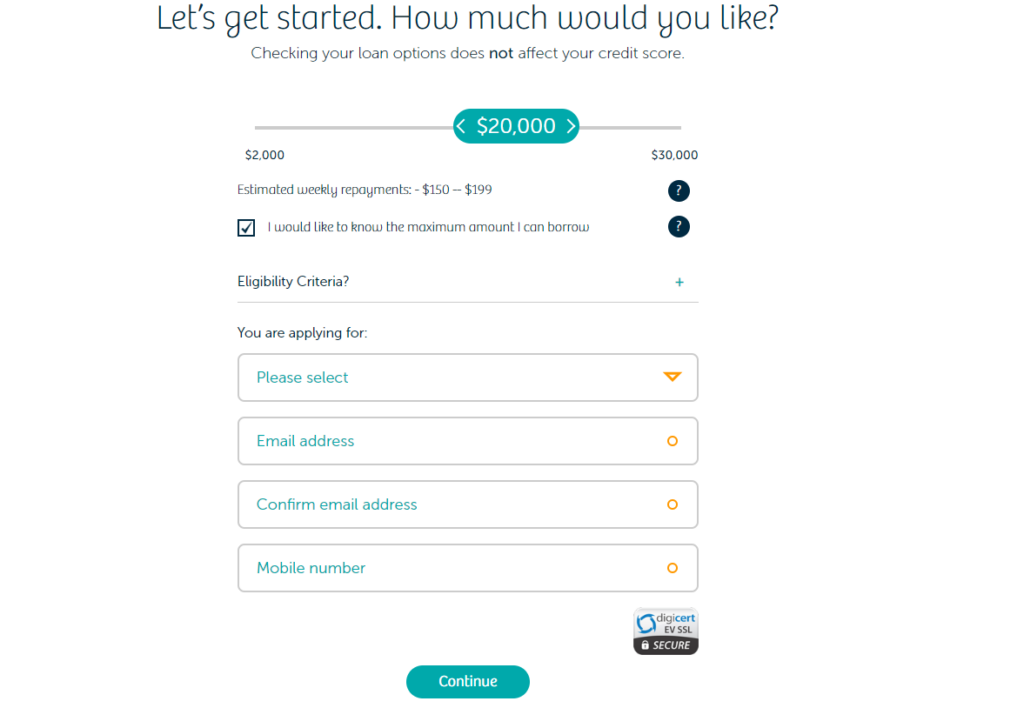

- Nectar offers unsecured loans from $2,000 up to $40,000.

- The lender’s application process is entirely online and it can fund successful applications within the same day. Nectar also has a phone support team, but they are only available during week days.

- A small administration fee applies to all repayments, which is important to factor in to your decision.

Key loan details

- Interest rate: 11.95% – 29.95% p.a.

- Minimum loan amount: $2,000

- Available terms: 6 months to 5 years

- Secured or unsecured: Unsecured

- Maximum loan amount: $40,000

- Establishment fee: $240

Author: Kevin McHugh, Head of Publishing at Banked.

About Nectar

Established and based in New Zealand, Nectar describes itself as a ‘digital lending company’ and its application process is 100% online.

The lender says that this allows them to make savings it can then pass on to its customers. It also means it is able to provide personalised quotes in as little as 7 minutes and make payments to customers within the same day.

Nectar is a registered Financial Service Provider in New Zealand (FSP694471). It is also a member of the Financial Dispute Resolution Service (FDRS).

Loans available from Nectar

Nectar provides unsecured loans that can be used for a wide range of uses. However, with loan amounts ranging from a comparatively low $2,000 up to $40,000, its loans are best suited to those looking for small to medium-sized finance.

If you’re looking to fund a larger purchase, we suggest you look at other lenders.

Personal loans

With loans that can be applied for and paid out within a day, Nectar’s personal loans will appeal to those who need funds quickly.

As with all of Nectar’s loans, its personal loans are unsecured. This means applications can be more straightforward as there is no need to assess an asset that would be used as collateral.

The lender’s personal loans can be used for emergency purposes, weddings, holidays and for many other reasons.

Car loans

Nectar’s car loans are unsecured, which is less common. Secured loans typically involve lower risk for the lender and a lower interest rate for the customer.

Starting from $2,000, its car loans might appeal in particular to those looking for a cheaper, second-hand vehicle.

Debt consolidation loan

A debt consolidation loan can some people with outstanding debt in other areas simplify their repayments and possibly pay less in interest.

Nectar’s debt consolidation loans allow you to repay in either weekly, fortnightly or monthly instalments to suit your pay cycle.

If you are interested in a debt consolidation loan, make sure to get a quote first, fully understand the repayment schedule and interest rates, and be sure it’s the best choice for you before progressing.

Home improvement loans

Nectar provides loans that can for renovations, kitchen or bathroom upgrades, repairs and most any other home improvement need.

As an unsecured loan, this loan will not require you to put up your home (or anything else) as collateral for the loan. It also means you may have greater flexibility in how you use the loan.

Fees

We don’t love that the lender has an establishment fee of $240. Not all lenders charge an establishment fee, and for those that do (such as Harmoney), it is usually lower than $240.

We also don’t like that Nectar charges an administration fee of $1.75 for all repayments. While this isn’t a large amount, it will add up over time – especially if you choose to pay in weekly installments.

However, Nectar doesn’t charge a fee for early repayments. This is a big win in our book and something we think should be standard with all lenders.

These all are the fees involved with a loan from Nectar. Bear in mind that some of these fees will only apply if you change or break the terms of the contract with the lender, such as failing to make payments.

- Establishment fee: There’s a fee of $240 for setting up a loan.

- Administration fee: $1.75 is charged for processing each repayment made. This is an incentive to pay in monthly, rather than weekly instalments.

- Dishonour fee: The lender charges a dishonour fee of $15 if repayment is not made on its agreed due date.

- Overdue fee: If a repayment is not made within 3 days of its due date, the lender will charge $25.

- Loan variation fee: If you need to change the terms of the loan, such as extending the loan term you will be charged $30. The lender must also agree to the change.

Learn more about Nectar’s fees on its website.

Key features

These are some of the features that you should take into account if you’re considering a loan with Nectar.

Only unsecured loans

All loans are unsecured. This means you won’t have to provide collateral to secure the loan, which could then be seized by the financial institution you borrowed from if you were unable to repay the loan.

With no collateral involved, unsecured loans are usually also simpler to apply for as they involve less paperwork.

However, unsecured loans also generally have higher interest rates than secured loans as they involve more risk for the lender. Learn more about the difference between secured and unsecured loans in our guide to personal loans.

It’s 100% online

Nectar’s application and approval process is entirely online. The application process takes around 7 minutes on average to complete and, if successful, loans can be paid out within the same day.

However, thankfully Nectar also has a customer service team available via phone between 9 am and 5 pm on weekdays. This is a good option to have as many people would prefer to speak to a person over the phone on financial topics.

Email is also an option if you have any issues or if you want to discuss your loan. Customer service agents are also available through the lender’s online chat service on its website.

It’s well regulated in New Zealand

Nectar is a registered financial service provider under the Financial Service Providers (Registration and Dispute Resolution) Act 2008.

Nectar is also a member of the independent Financial Dispute Resolution Service (FDRS). If you had a complaint about Nectar where you were unable to come to a resolution with it directly, FDRS can step in an attempt to resolve the issue.

Eligibility requirements

All lenders have their own criteria that applicants must meet before they will consider a loan. Here we take a look at Nectar’s own eligibility requirements.

- Age: You must be 18 years of age or older.

- Status: You must be either an NZ citizen or a permanent resident.

- Required documentation: You must have either an NZ passport or an NZ

- driver’s licence. You must also have an NZ bank account.

- Employment and income: You must be earning at least $350 per week after tax. Nectar does not consider applications from those who are self-employed.

- Credit history: You must not have any significant unpaid defaults or previous bankruptcies.

Unfortunately, Nectar doesn’t support loans for those in New Zealand for work, so if you’re in the country on a work visa, you will have to consider other options. Check out our guide to loans for work visa holders for more.

Pros and cons of a Nectar loan

Pros

- Loans start from $2,000, which is lower than most lenders and means that customers with more modest requirements can get the funding they need without unnecessary debt.

- There are no early repayment fees.

- Nectar is open and upfront rates and fees involved in its loans, which is a big plus.

Cons

- An admin fee of $1.75 applies to each repayment.

- Nectar doesn’t offer secured loans, which typically involve lower interest rates (even if you have to provide something as collateral).

Verdict

We like Nectar for its transparency around fees and interest rates. We also appreciate that it has a customer support team that is available over the phone, rather than choosing to manage everything through its website or email.

We are not a big fan of some of its fees, however. An administration fee for all repayments made is uncommon and while $1.75 isn’t too much, it can certainly build up over time with each repayment made.

Nectar’s establishment fee is reasonable but there are other lenders that charge less. However, if Nectar is able to give you a lower interest rate than other lenders, these fees may be much less of an issue.

Overall, if you’re looking for a small-to-medium-sized unsecured loan see what Nectar can offer you, but be sure also to check out other options before making a decision.